What Homebuyers Need To Know About Credit Scores

Some Highlights

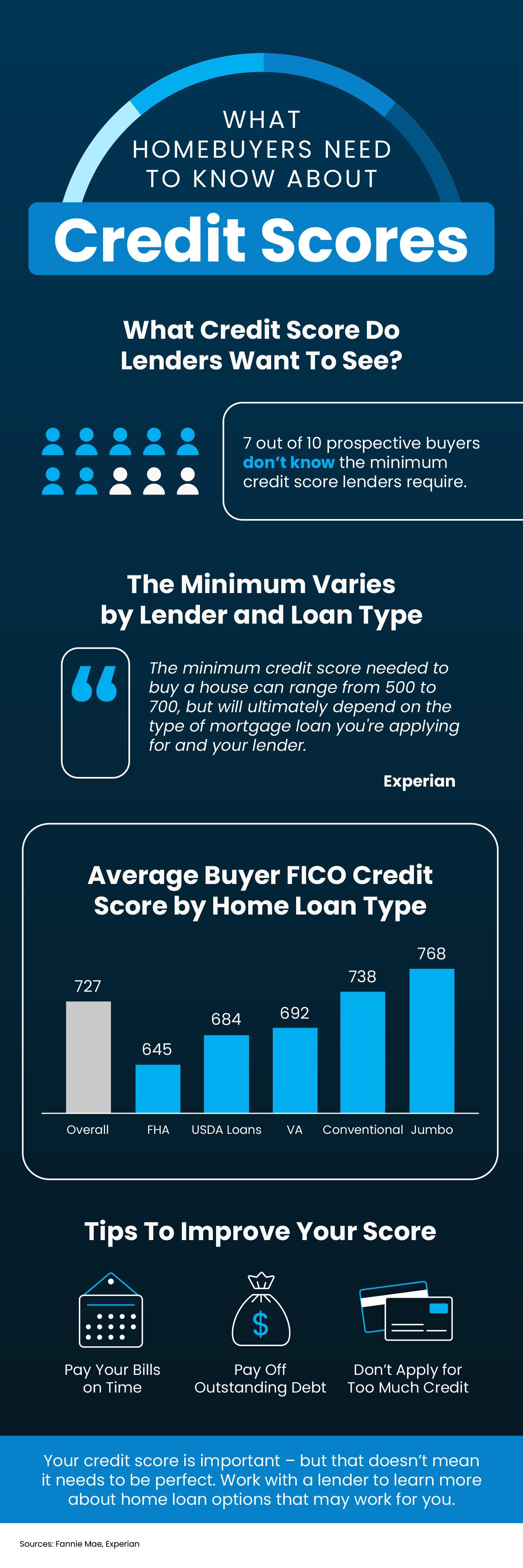

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

Categories

Recent Posts

Are Big Investors Really Buying Up All the Homes? Here’s the Truth.

The #1 Regret Sellers Have When They Don’t Use an Agent

The Credit Score Myth That’s Holding Would-Be Buyers Back

Expert Forecasts Point to Affordability Improving in 2026

Thinking about Selling Your House As-Is? Read This First.

Why Pre-Approval Should Be Your First Step – Not an Afterthought

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

"Dedicated to delivering exceptional client experiences, I combine expertise, professionalism, and a client-focused approach to achieve outstanding results in real estate."